Nationwide, banks are agreeing to more short sales, and for the first time, short sale transactions are exceeding foreclosure deals, according to the most recent housing data from Lender Processing Services (LPS) Inc.

In January, short sales made up 23.9 percent of home purchases, according to LPS. Meanwhile, foreclosures made up 19.7 percent of sales.

Just one year prior, foreclosures made up the bulk at 24.9 percent of transactions while short sales made up 16.3 percent.

“It’s a fairly recent phenomenon that short sales have been increasing,” Jonathon Weiner, a vice president with LPS, told Bloomberg News.

So why are banks getting more agreeable to short sales? Banks are realizing that short sale transactions usually sell for higher prices than foreclosures. In fact, foreclosed homes tend to sell for 29 percent less, on average, than comparable non-distressed properties. Short sales tend to sell at a 23 percent discount, according to Lending Processing Services data from January.

Banks and government agencies in recent weeks have taken steps to speed up the short sale process, setting new timelines for how long mortgage servicers have to respond to short sales offers. Also, some banks, such as Wells Fargo and JPMorgan Chase, are even offering some home owners cash incentives — up to $35,000 — if they agree to do a short sale instead of let the home fall into foreclosure.

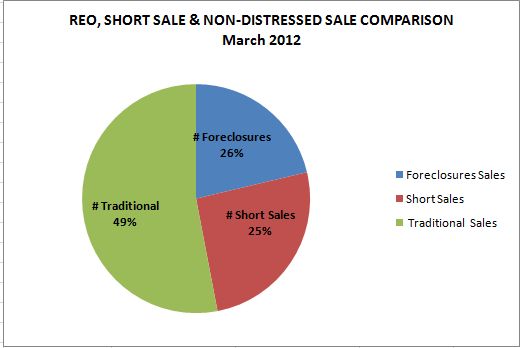

In the Phoenix real estate market, short sale account for 25% of all transaction as compared to 26% for foreclosures. Currently, Phoenix real estate is a hot item for investors and home buyers where the majority of transactions are with traditional home sellers. A year ago, Phoenix short sales accounted for 16% of all transactions as compared to 27% for foreclosures.