Turn on the news or browse the Internet these days, and you’ll immediately hear about interruptions to the supply chain caused by staffing shortages and health restrictions due to the COVID-19 pandemic.

If you go deeper down that rabbit hole, you’ll hear about how interruptions in the supply chain contribute to higher inflation and whether you should be concerned about inflation.

But what is inflation? And, what is the inflation effect on rent? We’ll answer these questions below and tell you when to increase rent on your income property.

1. What is Inflation?

Simply put, inflation is the decline of a currency’s purchasing power over time, and the inflation rate is the rate at which purchasing power declines annually or monthly.

Inflation means your dollar buys less than it used to over time, and, consequently, the price of goods and services goes up over the years.

Inflation is bad for consumers because they have to work harder to earn more to buy the same goods they did in the past.

If you’re a rental property owner, tenant boards allow landlords to raise rent legally to keep pace with inflation.

2. How Does Inflation Affect Rent?

Generally, inflation positively impacts rent for property owners because it means that they can increase rent, and therefore, the income they bring keeps pace with the rising price of goods. Inflation also benefits property owners because construction prices go up, which means fewer new rental properties are available.

Of course, inflation isn’t all positive for landlords because as their rental income goes up, so do their expenses. At the same time, rental rates tend to remain consistently on an upward trajectory during harsh economic times, which is why investing in property is seen as a good hedge against the effects of inflation and the rising cost of goods. Investing in real estate means you’ll always be able to keep pace with these costs.

As a nice bonus for rental property owners, inflation also increases the cost of housing, which means fewer people can afford to buy a home, increasing the demand for rental housing.

With increased demand and little supply, property owners are more likely to get the rental rates they’re asking for even if they’re a little high because even though goods and services may be more expensive. Everyone needs a roof over their head, and renting housing is generally cheaper than buying housing, even with inflation accounted for in both scenarios.

Source: Zillow Observed Rent Index (ZORI) (Seasonally adjusted); U.S. Bureau of Labor Statistics Consumer Price Index for All Urban Consumers (Seasonally adjusted); NAEH analysis. Recession data are from the National Bureau of Economic Research (NBER).

3. How Much Has Rent Increased in 2022?

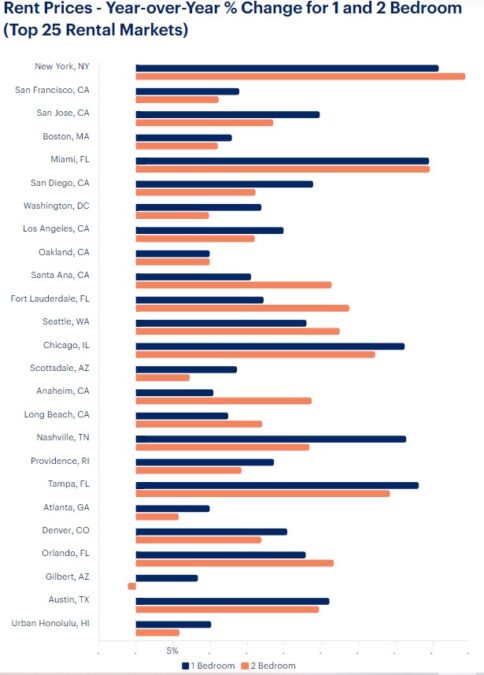

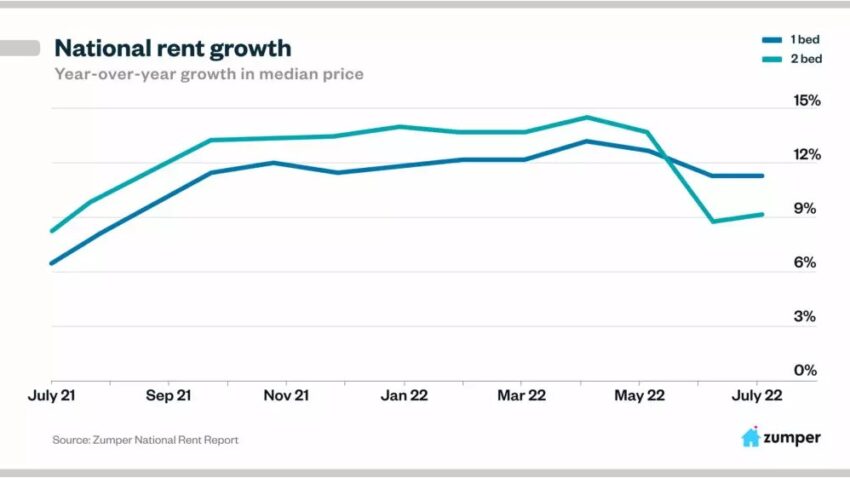

The pandemic has forced many Americans to tighten their wallets and reconsider living arrangements. National rent prices increased by 11.3% in 2021 compared to the previous year. This upwards trend continued into the first few months of 2022, with larger cities experiencing double-digit growth.

New York, California, Florida, and Indiana have seen big spikes in rent prices. The monthly rent for a one-bedroom in New York City is up by 40%, and major metros in California charge up to 25% for a one-bedroom. Other cities in Florida are seeing increases for single bedroom units ranging between 24% to 30% from the previous year.

New York, California, Florida, and Indiana have seen big spikes in rent prices. The monthly rent for a one-bedroom in New York City is up by 40%, and major metros in California charge up to 25% for a one-bedroom. Other cities in Florida are seeing increases for single bedroom units ranging between 24% to 30% from the previous year.

Rent price jumps are expected to continue, but some of the most expensive states to live in are slowly starting to level out. Even if the days of dramatic hikes are gone, there is still a projection of a 6% rise in U.S. rents this year— double the seasonal trends in “normal” years before the pandemic.

Rent price jumps are expected to continue, but some of the most expensive states to live in are slowly starting to level out. Even if the days of dramatic hikes are gone, there is still a projection of a 6% rise in U.S. rents this year— double the seasonal trends in “normal” years before the pandemic.

4. Does Rental Income Increase with Inflation?

As inflation drives up rent prices, landlords stand to make more net cash flow. This puts more money in your pocket, but as the costs of goods and services increases, your higher rents, or a portion of them, will be offset by the rising costs of managing and maintaining the rental properties.

Rental Property expenses that have increased during this high inflation period include:

- Maintenance expenses (lawn care, painting, etc.)

- Major renovations (roof replacement, new water heater, etc.)

- Mortgage rates (driven by Fed interest rate hikes)

- Property taxes (driven by higher property market values)

- Marketing costs to find tenants (Broker fees)

- Interest rates on non-confirming loans (Private and Hard money lenders have also increased interest rates)

- Landlord insurance premiums

You may be wondering by how much? Here are some indicators of consumer prices between June 2021 and June 2022:

The cost of energy, household furnishing and supplies and services (among other things) have increased 41.6%, 10.2%, and 5.5% (less energy services) respectively.

The cost of Building Material and Supplies Dealers increased from 153.50 in January 2020 to 233.562 in June 2022, an increase of 52%.

So what? Why does this matter for landlords and rental property investors?

Our take is that if you don’t raise rents to keep up with this high inflation period, your rental properties net operating income will likely decrease by 10%+ (assuming rents don’t change). If you do raise the rents by let’s say by approximately 10%-15%, you protect your existing net operating income. If you want to increase your net operating income then you likely have to raise rents a lot more (25-40%), but you should be careful about how and when you do that.

5. Why, When, How to Raise the Rent and Keep Tenants

It’s not just a question of when you can raise the rent by law, but under what circumstances you should raise the rent. This is often a question landlords struggle with because, according to the 2019 Group Consumer Housing Trends Report from Zillow, 78% of renters experienced a rent increase in 2019, where 55% of those people stated that their decision to move was directly tied to that rent increase.

Why raise the rent?

No renters, no income. As a result, you have to approach raising the rent with careful consideration and empathy for your tenants. It’s recommended that you increase the rent under the following circumstances (not comprehensive):

- Market rates have increased

- Property maintenance expenses that need to be covered

- Property taxes have increased

- Insurance premiums have gotten higher

- Homeowner’s association or condo fees have gotten higher

You cannot raise the rent as a landlord or owner under the following circumstances:

- You try to raise the rent during an active lease

- The lease doesn’t allow for a rent increase

- Advance notice for a rent increase wasn’t given properly

- The property is rent-controlled

- The increase is or can be seen as retaliation against a tenant

- The increase meets the standard for discrimination against a tenant according to the Fair Housing Act

- The increase is being done as a way to force a tenant to move out

- The increase is to a level prohibited by local law

When to raise the rent?

The standard timelines for landlords to raise rent prices include:

- When an existing lease expires. You can’t increase the rent until the current lease term expires unless the rental agreement you signed with a tenant includes conditions for rent increases during the lease period.

- When a lease converts from annual to monthly. Some landlords use a holdover clause in a lease agreement that states rent will automatically increase in the case that an annual lease converts to a monthly lease for the applicable unit occupied by the same tenant.

- When a new tenant signs a new lease agreement. Landlords have fewer restrictions on increasing rent for new tenants. Before setting the new rent price, check the market rate for rent in the area, and raising it too high could drive good tenants away.

How to increase the rent?

Raising rent prices is slightly different for month-to-month tenants versus annual lease renewals. Be sure to review state laws regulating rent increases.

How to increase rent for month-to-month leases:

- Determine the rent increase based on market rates and state laws.

- Give tenant(s) written notice in accordance with state-mandated notice periods (usually 30 days).

- Request tenant confirmation of receiving the written notice.

For annual lease renewals, it’s suggested that you reach out two months before the lease expires to discuss rent increases, and this gives you time to take action if the tenant chooses to argue the increase or vacate the property.

There are a few ways to apply a rent increase at renewal:

- Modify the existing lease:. The lease should state that all terms will remain the same except the new end date and the new rent.

- Draft a new agreement: Sign a new lease stating the new start and end dates, new rent price, and any other changes to the lease terms.

- Serve the tenant’s notice:. You may only have to serve a written notice depending on the lease terms.

Similar to the lease itself, the written notice for annual and monthly lease agreements should state:

- Landlord and tenant contact information

- The new rent amount

- The effective date the rent increase starts

- Rent payment options

- Both parties’ signatures

You should also consider adding a brief description of why the rent is increasing and how tenants will benefit. For example, a rent increase will allow you to continue providing high-quality amenities and property maintenance.

Our Final Thoughts on the Inflation Effect

For the most part, inflation is beneficial to landlords because it raises the cost of housing which raises rents in turn and, therefore, their gross income. This is because the demand for rental housing increases as people become more willing to pay high rents than an unmanageable mortgage in that economic environment.

As a landlord, you may have higher expenses due to the cost of goods and services going up. Still, having a rental property means you’ll largely be shielded from the consequences of inflation because the rents on your property will keep pace with the inflation rate. You’ll likely be able to pay your rent increases beyond just covering your expenses for a nice tidy profit.

Source: Baseline