Campaign ads are already airing. Debates and town halls are being held. Democratic primaries and caucuses are underway. Some eight months away from voting day, the 2020 election cycle is ramping up. However, while some presidential hopefuls are laying out their housing policies, the impact of the electoral process on residential real estate is yet to fully unfold.

Across the nation, the market still seems set on its normal trajectory. In January, nationwide inventory continued to decline, while median listing price climbed to nearly $300,000. According to realtor.com, last month marked a re-acceleration in price gains, as an increasing number of cities posted yearly growth of over 10%.

Still, research and industry experts agree that the closer the election gets, the more likely its effects on housing, regardless of who the candidates are. In general, presidential races breed uncertainty in the housing market, which alters attitudes among home shoppers, sellers and investors and, thus, sways sale volumes and values.

“Why [presidential elections] affects the market more than any other elections is simply because people fear change,” says Matt Laricy, managing broker of The Matt Laricy Group in Chicago. “Whenever people get nervous, they don’t make rational decisions. They make emotional decisions.”

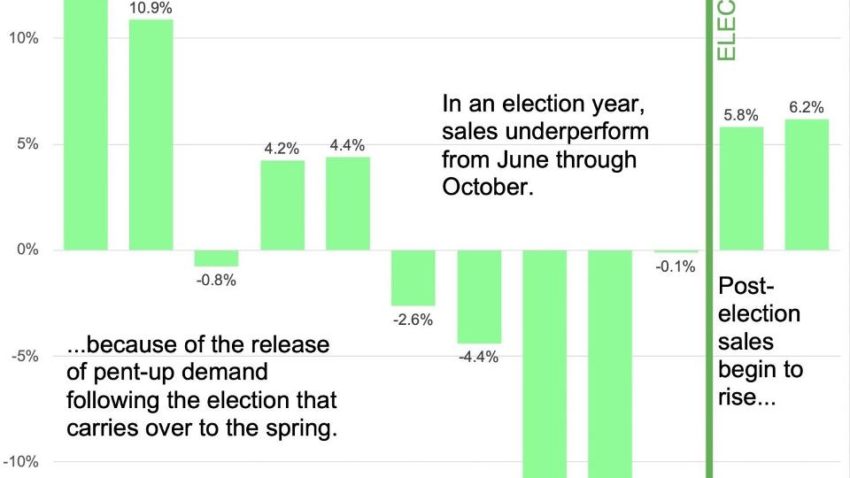

On a large scale, though, that behavior tends to mature with the progression of the election year and intensifies in the second half of that year.

How predictable the outcome of a presidential election appears to be can also influence real estate sentiments. When an incumbent arises as a likely winner, cementing the continuation of familiar policies, the housing market may experience less jitters, said Arlene Reed, a real estate agent with Warburg Realty in New York City.

When the election result evades easy forecasts, “people get a little tentative,” Reed says. “There’s some uncertainty how the new president’s policies will affect the economy, the stock market, taxes.”

Sales slide down, but prices may not budge

In a recent study that analyzed the last 13 presidential election years, which stretch back to the 1980s, Meyers Research, a housing consultancy firm, found out that new home sales record a drop in median sale activity of 15% from October to November, when the nation chooses its president. In the year following the election, the traditional seasonal decline in the sales of new construction abodes is only 8%.

Appraiser Jonathan Miller, owner of Miller Samuel, made a similar observation for Manhattan’s co-op sales in a data crunch he originally conducted for the real estate publication The Real Deal. Between 2008 and 2019, co-op sales began to dip in July of federal election years (both midterms and presidential elections), leading to a nearly 13% weaker market in September.

“Even though the election is at federal level and we’re looking at the local market, it’s still very visceral to consumers,” Miller says.

In most markets, though, the rebound is quick, if not instantaneous as pent-up demand gushes out after clarity dawns in the Oval Office.

“In December [following an election], and in the following year, the sales that are lost during November are recovered,” says Ali Wolf, director of economic research for Meyers Research. “It isn’t that consumers say, ‘I’m nervous, and I never want to buy.’ They say, ‘I’m nervous. Let’s just wait to see how things play out.’”

The impact of presidential elections on prices seems less clear-cut. Because any fluctuation in sale volumes occurs for only a limited number of months, prices may not have enough time to reflect that change. In New York City, Miller says, “it really takes anywhere from one to two years in sales pattern to have a permanent change or a significant change in price direction.”

This year, Daryl Fairweather, chief economist at online brokerage Redfin, says prices may not budge much, buoyed by a consistently tight inventory. Fairweather said that “prices are pretty stable.”

Lawrence Yun, chief economist at the National Association of Realtors and fellow Forbes.com contributor, echos that assertion, saying that he “hope[s] the price increase in 2020 is more moderate at 3% or 4%,” compared to past years.

If prices do post smaller gains in 2020, however, the presidential election might be one factor for that. In 2012, analyzing data by the California Association of Realtors, Movoto, a real estate technology company, concluded that in presidential election years price appreciation falls about 1.5% behind the gains made in the year preceding and the one following the vote.

Potential winners and losers

The effects of presidential elections on residential real estate usually reverberate louder in the upper echelons of the market. Yun says, “Upper-income people will probably wait until after the election compared to more middle-class, everyday people just because any changes to a new tax law or new regulations could have a bigger impact for them.”

During a presidential election, many foreigners also choose to postpone purchasing property in the U.S. as the rules that govern the tax and residency implications of such an action could change with the arrival of a new administration. Laricy says he has several international clients who have already decided to wait out the outcome of the November vote.

However, with today’s favorable economic outlook when it comes to mortgage rates, unemployment and consumer confidence, the upcoming presidential election might do little to impede first-time buyers or those shopping for lower-to-median values homes.

“They’re really more concerned about, ‘Do I have a job? Is the economy going to continue to grow?’” Wolf says. “Who gets elected can impact that but as long as there’s not some wild policy, those groups will generally continue to fare well in an election year or not.”

Position Realty

Office: 480-213-5251