Have you ever wondered whether your lender has properly calculated your outstanding loan balance. All too often, we take for granted the mortgage loan balances given us by our lender, and never bother to check the figures ourselves. When we go to sell our house, the excitement of the settlement process often makes us overlook an important issue: was the loan payoff statement provided by our lender accurate?

Different lenders have different computer programs. However, at the end of each year, a mortgage lender is obligated to provide all borrowers with a statement indicating how much mortgage interest was paid during the previous year, and — if taxes were collected in escrow — how much was paid for the real estate taxes on the property.

Some lenders provide a running monthly statement, showing the old loan balance, the amount of the payment broken down into interest and principal, and the new loan balance after crediting the principal payment. Keep in mind that when you make a mortgage payment to your lender, interest is calculated first on the then-outstanding balance, and the difference goes toward reducing principal.

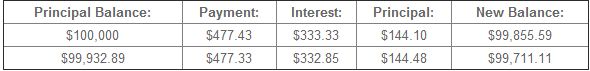

Let’s look at this example. You borrow $100,000 at 4 percent interest, to be amortized over thirty years. The computer — or an amortization program — tells us that the monthly payment required to fully pay off (amortize) the loan over a full 30 year period is $477.43. If we do some basic calculations, the first payment consists of $ 333.33 for interest and only $144.10 for principal. It should be noted that for the first seven years, you will be paying a lot more interest than will be credited toward the principal balance.

Thus, our example looks like this for the first two payments::

Interest is always calculated on the then outstanding balance for the previous month, which is why the interest goes down (ever so slowly at first) and the principal goes up (ever so slowly).

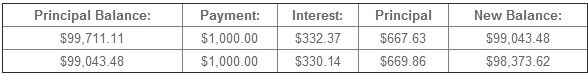

If you did not make any extra payments over the life of your loan, these calculations can be done quickly — either by hand or preferably by using a computerized amortization program. However, if you have made a larger monthly payment, then you have to do the numbers. Let us further assume that in the third and fourth month, you decide to make a payment of $1,000, instead of the regular payment. The next two month’s calculation would look like this:

As can be clearly seen, if you make a larger payment every month, you will significantly reduce the length of your loan. In fact, if you make one extra monthly payment per year, you will reduce a 30 year loan down to approximately 22 years. And I recommend you spread the extra payments over the 12 month period, rather than making one lump sum at the end of the year.

If you decide to make these extra principal payments, make sure that you clearly notify your lender each time that you are making such extra payments. Write “Extra Principal, $___” on both the check and the mortgage statement which you send in to your lender.

If you do not have access to a computer, the math calculations — while easy — can be time consuming. Thus, each and every year, when you get your year end statement, you should spend a few minutes doing the calculations for the previous year, so as to confirm that the numbers are correct.

If you are having trouble reconciling your numbers with those provided by your lender, you should immediately request a payment history statement from your lender. At least once a year, your lender should be able to provide this to you — free of charge. Examine the statement carefully; make sure you have not been improperly charged late fees or other similar charges. Make sure that any extra payments you may have made during the previous year have been properly credited toward your principal balance.

Lenders and their computers are not always correct. But only you can confirm.

Position Realty

Office: 480-213-5251